Times Call

The nation’s leading business economists are growing more pessimistic by the day about the chances for a sharp rebound from what they call an economic shock unlike any the country has ever seen.

“I won’t candy coat the outlook. It is obvious we will see a severe contraction,” Jack Kleinhenz, chief economist of the National Retail Federation, said on a conference call hosted by the National Association of Business Economics on Monday.

Initially, the hope was that the U.S. economy might quickly rebound once infections declined, restrictions on movement were lifted and fiscal stimulus kicked in. That was the V-shaped recovery scenario. Then economists began talking about a more stretched out or U-shaped recovery as cases rose, unemployment claims spiked and California, New York and Illinois locked down their populations. Denver County on Monday joined that group, ordering its residents to shelter-in-place as of 5 p.m. on Tuesday, before loosening up the rules to let people continue to visit liquor stores and recreational marijuana dispensaries after those were hit with a rush of shoppers. The city of Boulder also issued a stay-at-home order on Monday.

“It will not be a V-shaped recovery. It won’t even be U-shaped. It will be L- or hockey-stick shaped,” said Yelena Shulyatyeva, a senior U.S. economist with Bloomberg. “It is not a temporary situation. It will stay with us for some time.”

An L-shaped recovery involves a steep decline followed by an economy that lays there flat on its back for an extended period, not unlike a player who takes a hockey stick to the head and is knocked out cold.

Chinese consumers cut spending by 20% during the country’s lockdown, but the U.S. is facing a contraction of 30% or more, said Kleinhenz. Consumer spending accounts for about 70% of the U.S. economy and businesses are rapidly jettisoning workers rather than trying to ride the storm out.

As for a path back to normal, “We don’t have a road map to do that,” Kleinhenz said.

Colorado, despite having one of the more diversified state economies, also has a heavy concentration of jobs in tourism and oil and gas, another industry that could see layoffs soon if there isn’t a rebound in prices, which are down by two-thirds from the start of the year. Demand for oil has fallen 10% in three months. The last time it fell that much was in 1979, and that decline happened over three years, said Mark Finley, a fellow at the Baker Institute Center for Energy Studies.

At the same time as demand is dropping, Russia and Saudi Arabia are ramping up production in a price war. Once storage capacity fills up, prices could see another wave down unless the two countries reach an agreement to cut production, Finley warned.

A

Brookings study last week estimated that about 400,000 jobs in Colorado’s metro areas most at risk, led by Denver with 255,516 jobs and Colorado Springs with 47,444 jobs at risk. Measured on a percentage-basis, Greeley and Grand Junction are among the most vulnerable metros in the country, with more than a fifth of the workforce employed in the highest risk industries.

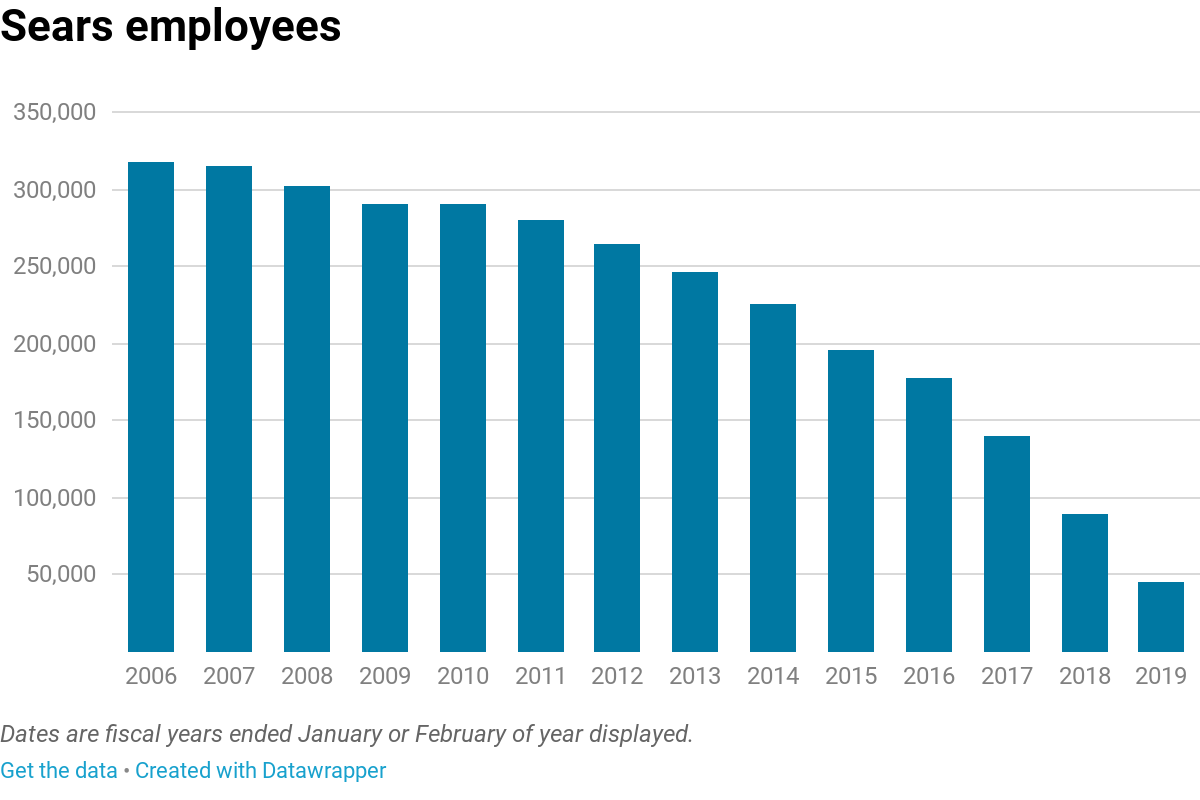

The study didn’t include retail as a high-risk category, but brick-and-mortar retailers in the state, who employ an additional 272,200 workers, are shutting down operations. Belmar in Lakewood said it was closing down at 7 p.m. on Monday and would reopen on April 6.

“Thank you for your understanding as we move through these unprecedented times together,” the outdoor mall said in a release.

On Sunday night, St. Louis Fed President James Bullard told Bloomberg in an interview that U.S. GDP could be cut in half in the second quarter. Those kind of declines are associated with a depression, not a recession.

“This is a planned, organized partial shutdown of the U.S. economy in the second quarter. The overall goal is to keep everyone, households and businesses, whole” with government support. It is a huge shock and we are trying to cope with it and keep it under control,” he said.

When asked whether the current situation resembled the Great Depression, a member of the NABE panel said it didn’t. As long as the financial system holds up, which it appears to be doing thanks to massive intervention by the Federal Reserve, then the country should avoid a depression, said Ken Simonson, chief economist with the Associated General Contractors of America.

“We haven’t had banks closing all over the country. We have a much more robust financial safety net,” he said. “We are not in for 10 years of declining or subdued activity.”

Another sign that employers are losing hope for a fast rebound in the economy — they are laying off their workers in large numbers rather than waiting out a temporary disruption. Research consistently shows that employers who aggressively cut staff in response to a downturn harm their long-term prospects much more than those who grit it out, said Wayne Cascio, a distinguished professor of management at the University of Colorado Denver, an expert on the topic.

“Employers should do as much as they can to avoid cutting people with mission-critical skill,” he said. “The longer they can hold out before taking drastic action, the better off they will be.”

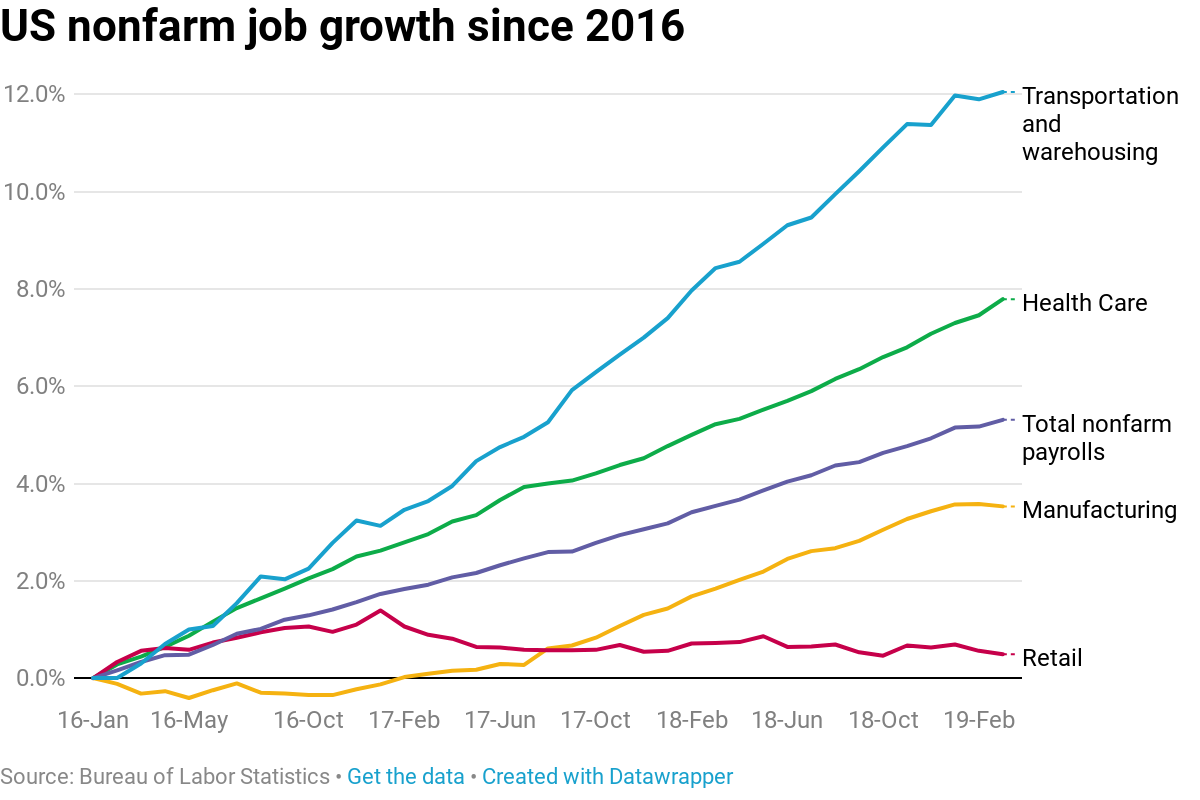

But he also acknowledges the country has never faced a shutdown on a scale it is now seeing. Many of the first wave of layoffs are coming in industries that pay lower wages and have higher turnover. Workers in hospitality and retail are more likely to be viewed as easily replaceable rather than mission-critical. Yet, the severity and swiftness of those layoffs will reverberate throughout the economy, and delay any recovery.

Last week, the Colorado Department of Labor strained to process 26,000 claims for unemployment benefits, and many displaced workers said they were blocked from filing. On Monday morning, the department fielded 86,000 calls before the phone queue opened at 8 a.m., noted executive director Joe Barela. A week ago, there had been 9,000 calls before the queue had opened.

“All of our systems are overloaded — as are UI systems across the country — and we know frustration and anxiety is high. We are doing the best we can to navigate these uncertain times and want claimants to know their benefits will not be reduced due to any filing delays,” he said in an update sent by email.

It will take several weeks for official measures to capture what is happening this month. But surveys are showing massive job losses that are causing consumer confidence to quickly evaporate. Maintaining that confidence was key for any V-recovery.

LendEDU surveyed 1,000 adults in the U.S. and found that 6% said they had already lost their job because of the COVID-19 outbreak, while 11% had retained their jobs but weren’t working, making them likely candidates for a future layoff. Another 13% had their work hours reduced. The survey also found that among those who had lost work, 82% said they were living paycheck-to-paycheck. They have no reserves to fall back on.

Homebase, which provides an online system for tracking employee work hours, reports a 40% drop in Denver-area business clients still open as of Sunday, and a 53% decline in the number of workers clocking in on its system.