U.S. retail sales rose more than expected for the second consecutive month in June as the economy reopened, but experts say recovery remains uncertain given the new spikes in COVID-19 cases.

Retail and food services sales jumped 7.5% during the month, surpassing the consensus estimate of economists polled by Econoday of a 5.2% rise.

“June’s numbers show that retail spending is fueling the economic recovery,” Jack Kleinhenz, chief economist at the National Retail Federation, or NRF, said in a statement. “How durable the improvement in retail spending will be is directly related to how widespread the resurgence in COVID-19 cases becomes.”

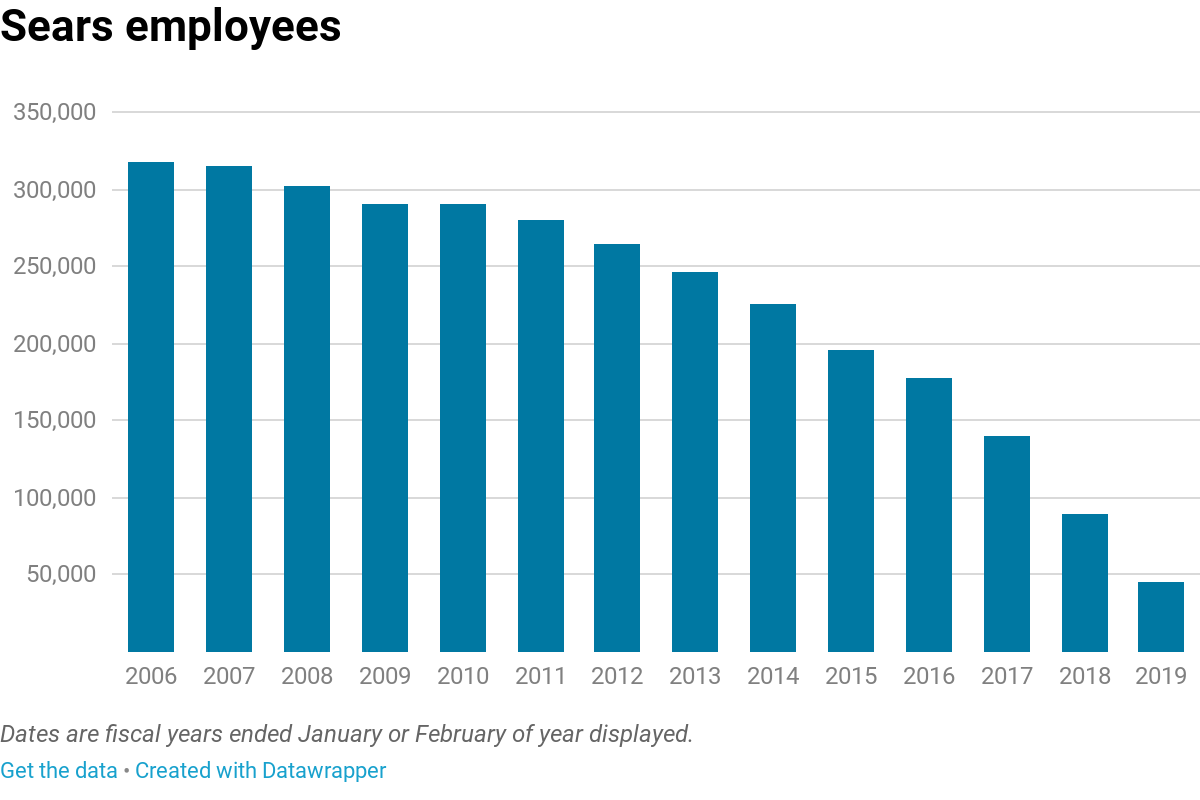

Meanwhile, nine retailers went bankrupt in late June through mid-July period, including vitamin seller GNC Holdings Inc. and retailer RTW Retailwinds Inc. The year-to-date bankruptcy count has already surpassed the number of filings in 2019 and 2018, according to an S&P Global Market Intelligence analysis.

Retail sales

U.S. retail and food services sales increased in June over the prior month to a seasonally adjusted $524.31 billion, according to a report released July 16 by the U.S. Census Bureau. This follows a revised 18.2% rise in May.

Several U.S. states, especially those in the Southeast and West, began reporting spikes in COVID-19 cases in June. The resurgence has prompted several states to either pause their reopening plans or shutter certain businesses.

The increase in retail sales in June “solidified the recovery that started in May and confirmed the strong — though uneven — snapback in demand,” Lydia Boussour, senior U.S. economist at Oxford Economics, said in a note. “Sadly, the alarming trajectory of the virus nationwide has put in question the sustainability of the recovery in consumption.”

NRF President and CEO Matthew Shay said the sales figures are encouraging and “reflect continued progress in the right direction.”

The jump in retail sales was driven by clothing and clothing accessories store sales, which rose 105.1% from May to $17.1 billion in June. Spending at electronics and appliance stores increased by 37.4% during the month to $7.05 billion.

Furniture and home furniture stores registered an increase of 32.5% in sales to $9.58 billion. Sales at gasoline stations rose 15.3% month on month to $33.63 billion, while spending on food services and drinking places jumped 20% to $47.43 billion.

“[W]hile today’s report gives the illusion of a fearless consumer spending lavishly, the reality is more sobering: consumers are increasingly fearful amid new spikes in COVID-19 cases and a looming fiscal cliff,” Oxford Economics’ Boussour said.

Meanwhile, nonstore sales, the category that includes e-commerce, decreased 2.4% to $82.80 billion in June. But on a year-on-year basis, online spending rose 23.5%.

“We do expect online sales to continue their extraordinary upward swing as consumers get comfortable adding more product categories on their online shopping list,” Moody’s Vice President Mickey Chadha said in a note.

Marwan Forzley, CEO of global payments firm Veem, said the “modest” monthly decline in online spending does not come as a surprise. “We are living in very volatile times with heightened uncertainty, which is bound to make some consumers cautious when it comes to spending money,” he told Market Intelligence via email.

Forzley added that the coronavirus crisis has changed the mindset of online spending. “Spending now starts online and is complemented offline as opposed to the pre-COVID mindset of starting the buying process offline first. I think that mindset shift will continue to fuel the relevance of e-commerce, online payments, supply chain payments and global payments at large,” he said.

The U.S. Labor Department separately said Thursday that unemployment claims in the U.S. declined to 1.30 million in the week ended July 11 from 1.31 million in the previous week.

Matthew Eidinger, fintech specialist at Cambridge Global Payments said in a note that the data on both consumer spending and the U.S. labor market should be “taken with a grain of salt,” as the rise in the coronavirus cases stands to threaten state reopening efforts across the entire Southern belt.

“Efforts to rollback economic reopenings could mean a loss of the momentum the economy has built up throughout May and June — prompting another wave of business closures and corresponding layoffs, which could threaten the recovery,” Eidinger said.

Consumer prices

The Consumer Price Index, or CPI, rose 0.6% in June from the previous month, data released July 14 by the U.S. Bureau of Labor Statistics showed.

Prices advanced 0.6% year on year.

The core CPI, which excludes food and energy prices, increased 0.2% in June, registering its first monthly rise since February. Food prices rose 0.6% month on month, while energy prices increased 5.1% during the month.

Prices for apparel increased by 1.7% in June versus the prior month. Prices for men’s and boys’ apparel rose by a seasonally adjusted 2.4%, while prices for women’s and girls’ apparel rose by 0.9%.

Bankruptcy

Nine Market Intelligence-covered U.S. retail companies went bankrupt in late June and early July, bringing total year-to-date bankruptcies to 38.

The year-to-date figure now outnumbers the total number of bankruptcies in 2019 and 2018. In 2019, 32 retailers went bankrupt, while 2018 saw 33 companies going bankrupt.

The analysis includes companies with a primary industry classification of retailing, household and personal products, or consumer durables and apparel, and a secondary classification of retailing. Public companies included in the list of companies with public debt must have at least $2 million in either assets or liabilities at the time of the bankruptcy filing. In comparison, private companies must include at least $10 million.

GNC Holdings filed a voluntary petition for reorganization under Chapter 11 on June 23. At the time of filing, GNC said it is pursuing a dual-path process that will allow the company to restructure its balance sheet via a stand-alone plan of reorganization or a sale of the company.

RTW Retailwinds, which owns apparel retailer New York & Co., filed a voluntary petition for reorganization under Chapter 11 on July 13 with plans to close most, if not all, of its stores. The company has launched the liquidation process and is evaluating strategic options, including the possible sale of its e-commerce business and related intellectual property.

Last month, RTW Retailwinds ranked 14th out of the 15 retail companies with the highest odds of defaulting within a year, according to Market Intelligence’s fundamental probably of default model.

Apparel brand Brooks Brothers Group Inc., founded in 1818, filed for bankruptcy July 8. The company listed both its assets and liabilities in the range of $500 million to $1 billion. A venture between mall owner Simon Property Group Inc. and apparel licensing firm Authentic Brands Group LLC will provide $80 million in bankruptcy financing to Brooks Brothers, according to The Wall Street Journal.

BHS Foodservice Solutions, which sells restaurant equipment and supplies, on June 26 filed a voluntary petition for liquidation under Chapter 7.

Other companies that filed for Chapter 11 bankruptcy in the period leading up to July 16 include home decor retailer Old Time Pottery Inc.; clothing retailer Lucky Brand LLC; Muji U.S.A. Ltd., which sells clothing, household goods and food items; and Sur La Table Inc., which operates a chain of stores that sell cookware, cutlery, dinnerware and other products.

Employment

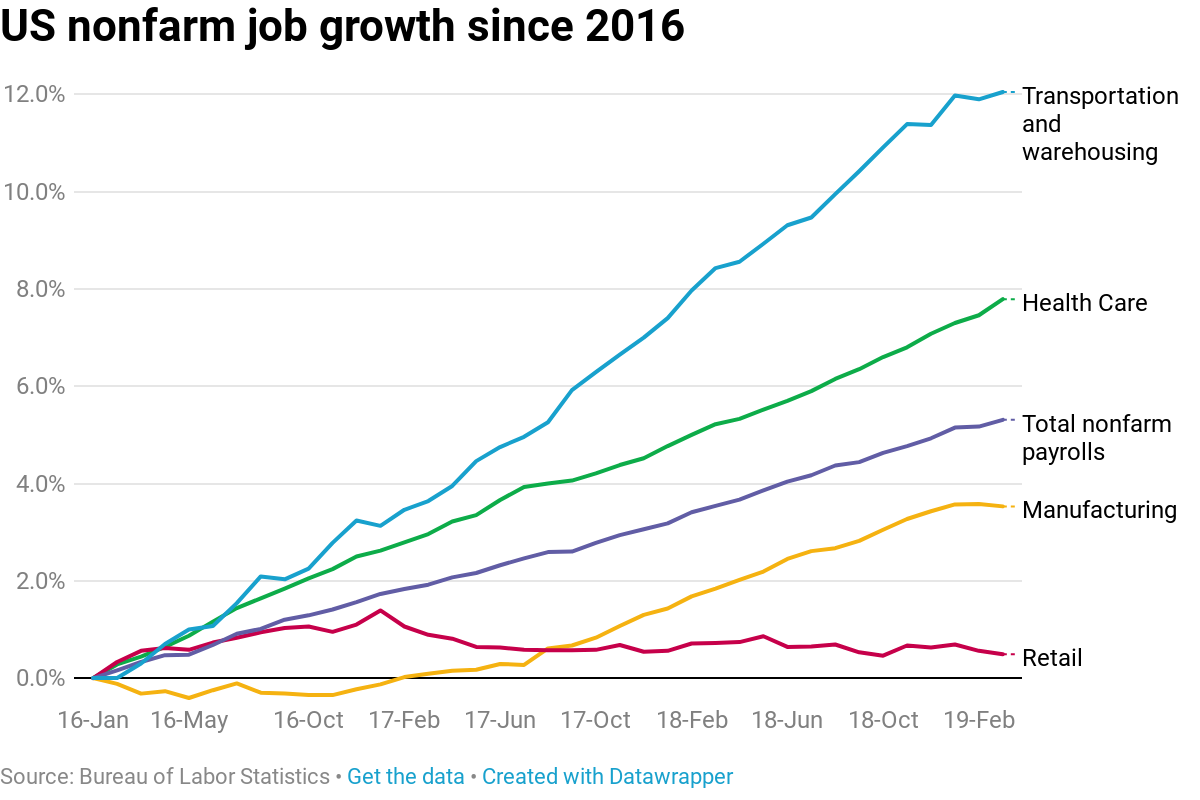

The retail sector in June gained about 740,000 jobs, a 5.42% month-on-month increase, to 14.4 million jobs, according to a July 2 monthly report from the U.S. Bureau of Labor Statistics.

Employment at clothing and clothing accessories stores increased 35.64% in June to 767,200 jobs. These stores gained 201,600 jobs during the month.

Furniture and home furnishings retailers added 84,200 jobs, up 28.30% from the previous month to 381,700.

Sporting goods, hobby, books and music stores registered an increase of 17.84%, or 65,500 jobs during the month to 432,700 total. General merchandise stores added 108,100 jobs, a month-on-month increase of 3.66%.

Vulnerability

A July analysis of the one-year probability of default scores identified 15 public retailers with scores ranging from 32.2% to 11.8% and corresponding implied credit scores of “ccc-” to “ccc+.”

The calculated one-year probability of default remained unchanged for all of the companies on the list except Merion Inc. and Twinlab Consolidated Holdings Inc.

Merion, which provides health supplements and personal care products, saw its one-year probability of default rise to 32.2% from 31.2% in June. The probability of default for Twinlab Consolidated Holdings increased to 24.7% from 24.2% the prior month.

All the retailers on the list held on to their spots, but Trans World Entertainment Corp. moved up one place to No. 14 after RTW Retailwinds filed for bankruptcy. This change also introduced a new company to the list: Kirkland’s Inc., a specialty retailer.

Kirkland’s on June 4 reported a pretax loss of $27.7 million for its first quarter as the coronavirus pandemic affected sales.

|

S&P Global’s Fundamental Probability of Default Model provides a fundamentals-based view of credit risk for corporations by assessing both business risk — including country risk, industry risk, macroeconomic risk, company competitiveness and company management — as well as financial risk, such as liquidity, profitability, efficiency, debt service capacity and leverage. For a more thorough review of the model, see the PD Model Fundamentals – Public Corporates white paper. |

S&P Global